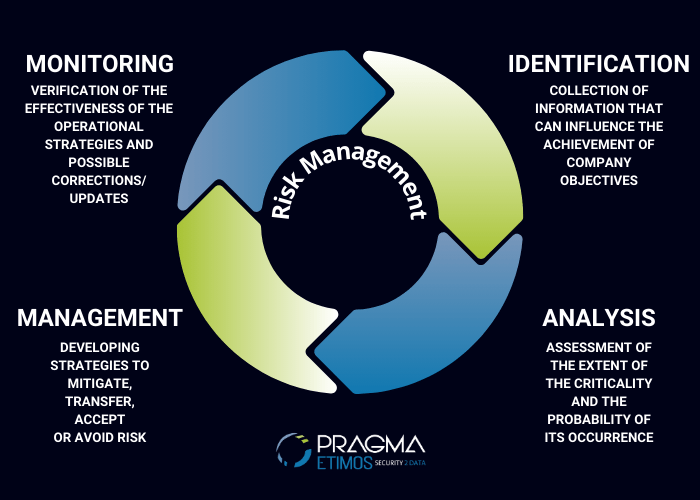

Developing a Risk Management plan is a particularly complex activity, which must consider a long list of factors, even distant from each other: from legal aspects to financial accounts, passing through the advertising sector, customer relations and commercial approaches.

This process is critical for organizations that aim to achieve their goals safely and efficiently. The various stages are essential to ensure that businesses are prepared to meet challenges and take advantage of opportunities in their target market.

It is interesting to investigate the main phases involved in the risk management process, where Artificial Intelligence plays a fundamental role.

Step 1: Identify Risks

The first step of Risk Management is the identification of the risks themselves.

This involves gathering information and data that can influence the achievement of business goals. Key elements of this phase include:

- Context analysis: assessing the organization’s internal and external environment to identify factors that could pose a threat or opportunity.

- Stakeholder involvement: understand the situation from all angles, both inside and outside the company, in order to obtain different perspectives on risk management.

- Data Collection: collect data and information on past events, industry trends, and regulatory changes that could affect the entire process.

Step 2: Risk Analysis

Once the risks have been identified, the next step is to analyse them. This phase aims to assess the extent of the criticality and its probability of occurring.

Key activities in this phase include: probability and impact assessment, risk classification, quantitative and qualitative assessment, e.g. statistical models and expert subjective assessments.

Step 3: Operational Risk Management

After analysis, the next stage is operational risk management, which involves developing strategies to mitigate, transfer, accept or avoid identified issues.

This step includes all the actual operating procedures, including:

- Developing mitigation plans: creating action plans to address risks, reducing their magnitude or likelihood of occurring.

- Coverage insurance: consideration of strategies or other forms of risk transfer to reduce the financial impact of adverse events.

- Implementation of risk management strategies: implementation of operational risk management plans and continuous monitoring of the effectiveness of these tools.

Step 4: Monitoring and control

The final stage of risk management is monitoring and control. This phase is crucial to ensure that operational strategies are effective over time and always up-to-date with market changes.

Investing in risk management is a proactive strategy that can significantly contribute to a company’s sustainability and long-term success. It helps protect financial interests, preserve reputation, and enable more informed business decisions.

In conclusion, Risk Management is a dynamic process that requires continuous commitment from companies.

By following these steps systematically, businesses can proactively identify, assess, and manage risks, ensuring they are better prepared to meet challenges and take advantage of opportunities on their path to success.

You may also like

APOLLO: everything you need to know about KYC

The acronym KYC, which stands for “Know Your Customer”, is a fundamental concept in the field of finance, anti-money laundering and transaction security. Crime has always found a way to illegally exploit the identity of individuals for certain practices, a phenomenon…

Wrong addresses: how to remedy mistakes?

In the complex web of everyday interactions, addresses play a key role. Whether physical or digital addresses, they act as reliable guides that take us from one point to another, allowing us to reach the desired destinations, to receive the goods we buy online and to…